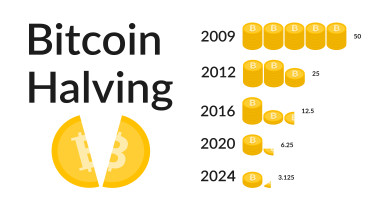

The Fourth Bitcoin Halving: A Transformative Milestone for the Cryptocurrency

As the 2024 halving approaches, the confluence of factors, including the approval of spot bitcoin ETFs, the evolution of a large liquid derivatives market, and the potential impact of Ordinals, could usher in a new era for bitcoin.

Read More

Navigating the Fast-Paced World of Decentralized Exchange Arbitrage

Arbitrage involves profiting from price discrepancies for assets across different markets. While not a new concept, applying arbitrage strategies specifically to decentralized exchanges requires adapting to unique conditions. This article offers guidance on successfully executing arbitrage trades across DEX platforms.

Read More

Ripple Labs Scores Victory as Court Rules XRP Token Not a Security

Ripple Labs, the blockchain company behind the XRP token, has achieved a significant victory in the United States District Court in the Southern District of New York. On July 13, Judge Analisa Torres ruled in favor of Ripple in a case brought forth by the Securities and Exchange Commission (SEC) dating back to 2020.

Read More

What are BRC-20 Tokens on Bitcoin? How Pepe Ruined BTC Transaction Fees

BRC-20 tokens are an experimental fungible token standard built using the Ordinals and Inscriptions concepts and stored on the Bitcoin base chain. Unlike the ERC-20 tokens on the Ethereum blockchain, BRC-20 tokens do not interact with smart contracts and instead rely on storing script files in Bitcoin to attribute tokens to satoshis and facilitate transfers between users. The introduction of BRC-20 tokens and the Ordinals protocol allows for the creation of fungible tokens on the Bitcoin blockchain, which was previously not possible due to the absence of smart contract functionality.

Read More

The Connection Between Network Congestion and Expensive Bitcoin Transaction Fees

The connection between network congestion and expensive Bitcoin transaction fees is a result of increased adoption, limited block size, and scalability challenges. During congestion, users compete with higher fees for their transactions to be prioritized. Proposed solutions include the Lightning Network and debates over the block size limit. Alternative cryptocurrencies have emerged, but Bitcoin's network effect gives it an advantage. Finding sustainable solutions while maintaining decentralization and security is essential. Ongoing research and collaboration are crucial for optimizing the Bitcoin network and reducing transaction fees.

Read More

Self-Custodying Your Cryptocurrency: Why You Need to Take Control of Your Digital Assets

Self-custodying your cryptocurrency is essential if you want to have complete control over your digital assets. It offers enhanced security, privacy, and control over your funds, which are crucial factors in the world of cryptocurrency. While using a third-party custodian may seem like a more convenient option, it comes with inherent risks that can compromise your funds

Read More

What Can I Do With the Bitcoin I Bought on Cash App

Bitcoin is an exciting and valuable digital currency that can provide great investment opportunities. If you're looking for a new and innovative way to invest in Bitcoin, copy trading at Bank of Bitcoin is definitely worth considering. By copying the trades of expert traders, you can benefit from their knowledge and experience, while potentially increasing your returns. So if you're ready to take your Bitcoin investment to the next level, sign up for copy trading at Bank of Bitcoin today.

Read More

The Ethics of Algorithmic Trading: Balancing Profit and Responsibility

While algorithmic trading offers many benefits, it is important to consider the ethical implications of its use. Regulators, exchanges, and firms all have a role to play in promoting transparency, fairness, and accountability in trading. As investors, it is important to educate ourselves about the risks and benefits of algorithmic trading and to make informed decisions about how to incorporate this technology into our investment strategies.

Read More

The Advantages of Copy Trading for Investors

By giving investors access to professional trading strategies, reducing the time and effort required to manage investments, providing diversification opportunities, offering transparency, and having low minimum investment requirements, copy trading has become an increasingly popular investment strategy in recent years.

Read More