The Connection Between Network Congestion and Expensive Bitcoin Transaction Fees

Bitcoin, the world's first decentralized digital currency, has gained widespread popularity over the years. It offers numerous advantages over traditional financial systems, such as decentralization, security, and transparency. However, one persistent issue that has plagued the Bitcoin network is the fluctuating and sometimes expensive transaction fees. To understand the reasons behind these high fees, it is essential to examine the connection between network congestion and expensive Bitcoin transaction fees.

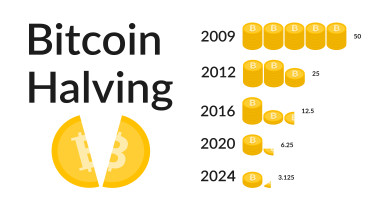

At its core, Bitcoin operates on a peer-to-peer network, where transactions are broadcasted to a network of nodes and then verified and added to a public ledger known as the blockchain. To ensure the network's security and avoid double-spending, each transaction requires confirmation by miners through a process called mining. Miners dedicate computational power to solve complex mathematical problems, and once a problem is solved, the miner adds a new block of transactions to the blockchain and is rewarded with newly minted bitcoins.

However, the mining process and the limited block size of the Bitcoin network introduce constraints on the number of transactions that can be included in each block. Currently, the Bitcoin block size is limited to 1 megabyte (MB), which means that only a certain number of transactions can be confirmed within a given block. This limitation leads to congestion when the demand for Bitcoin transactions exceeds the network's capacity.

When the number of pending transactions exceeds the available block space, users need to compete for inclusion in the limited number of blocks. To increase the likelihood of their transactions being included in the next block, users have the option to attach a transaction fee. Miners, motivated by financial incentives, prioritize transactions with higher fees, as they are more lucrative to include in the limited block space. Consequently, during periods of high network congestion, users are forced to pay higher fees to ensure their transactions are processed promptly.

Several factors contribute to network congestion and the subsequent rise in transaction fees. First and foremost, increased adoption and usage of Bitcoin contribute to higher transaction volumes. As more people start using Bitcoin for various purposes, such as remittances or online purchases, the number of transactions submitted to the network increases, straining the limited block capacity.

Secondly, the scalability challenge inherent in the Bitcoin network exacerbates network congestion. The 1 MB block size limitation was initially implemented to prevent spam transactions and maintain the integrity of the blockchain. However, as Bitcoin gained popularity, the block size limit became a bottleneck, unable to accommodate the growing transaction volume. This results in a backlog of unconfirmed transactions, longer confirmation times, and higher fees.

Moreover, sudden surges in demand can cause temporary spikes in transaction fees. Events such as initial coin offerings (ICOs), airdrops, or popular blockchain-based games can lead to a significant influx of transactions within a short period. Miners, responding to the increased demand, prioritize transactions with higher fees, resulting in a surge in transaction fees for those seeking faster confirmation times.

Additionally, the transaction fee market itself plays a role in the fluctuation of fees. Bitcoin's decentralized nature means that fee determination is driven by supply and demand dynamics. During times of low network congestion, users can choose to include lower fees, and their transactions will still get confirmed relatively quickly. However, during periods of high congestion, users have to outbid each other by offering higher fees to get their transactions prioritized.

The connection between network congestion and expensive Bitcoin transaction fees is undeniable. The limited block size, increased adoption, scalability challenges, and sudden surges in demand all contribute to network congestion, forcing users to pay higher fees to ensure timely confirmation of their transactions. While efforts are being made to address these challenges, such as the implementation of layer-two scaling solutions like the Lightning Network, network congestion and expensive transaction fees remain an ongoing concern within the Bitcoin ecosystem.

Efforts are underway to address the issue of network congestion and expensive transaction fees. One proposed solution is the implementation of the Lightning Network, a layer-two scaling solution built on top of the Bitcoin blockchain. The Lightning Network enables faster and cheaper transactions by creating off-chain payment channels that can handle a high volume of transactions without burdening the main blockchain. By leveraging these payment channels, users can conduct multiple transactions off-chain and settle the final result on the main blockchain, reducing congestion and lowering fees.

Another approach is the ongoing debate surrounding the block size limit. Some members of the Bitcoin community advocate for increasing the block size to accommodate a larger number of transactions within each block. However, this proposition is met with resistance from others who argue that a larger block size may compromise decentralization and increase the barrier to entry for running a full node. Finding a balance between scalability and maintaining the decentralized nature of the network remains a complex challenge.

It's worth noting that alternative cryptocurrencies, often referred to as altcoins, have emerged to address the scalability and transaction fee issues experienced by Bitcoin. These altcoins, such as Ethereum, Binance Coin, and Cardano, implement different consensus mechanisms and block size limits, aiming to offer faster and cheaper transactions. However, Bitcoin's network effect and widespread adoption give it a significant advantage over most altcoins.

In conclusion, the connection between network congestion and expensive Bitcoin transaction fees is a result of the limited block size, increased adoption, scalability challenges, and sudden surges in demand. As the popularity of Bitcoin continues to grow, it is crucial to find sustainable solutions to address these challenges and ensure that Bitcoin remains a viable and efficient means of conducting transactions. Ongoing research, technological advancements, and community collaboration will be key in optimizing the Bitcoin network and reducing transaction fees, enabling it to scale effectively while maintaining its core principles of decentralization and security.