The Fourth Bitcoin Halving: A Transformative Milestone for the Cryptocurrency

The Significance of the 2024 Bitcoin Halving

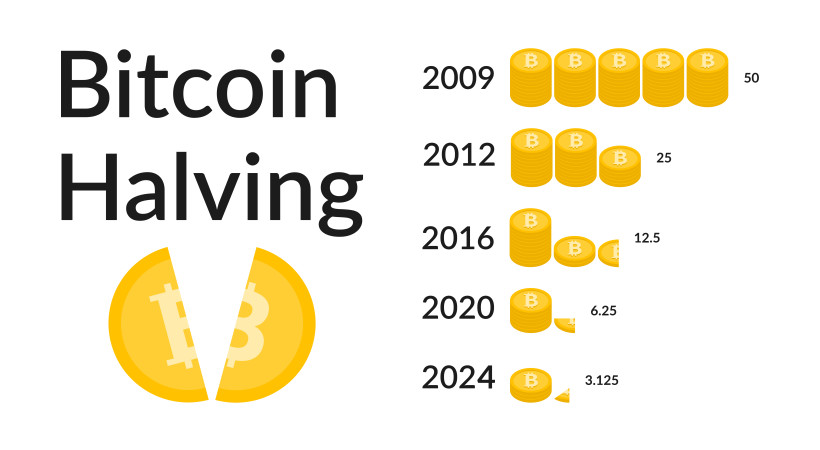

The fourth Bitcoin halving, expected to occur around April 19, 2024, marks a significant milestone in the evolution of the cryptocurrency. This quadrennial event, baked into the network's design since its launch in 2009, entails a reduction in the reward granted to miners for each block mined on the Bitcoin blockchain.

Specifically, the block subsidy - the newly-created bitcoin included as a reward for successful miners - will be cut in half, from 6.25 BTC to 3.125 BTC per block. This gradual decrease in the supply of new bitcoin entering circulation is a core part of Bitcoin's deflationary approach, aimed at maintaining the asset's scarcity and ensuring the laws of supply and demand consistently impact its value.

Historical Price Trends and the Halving

Historically, each previous halving event has been accompanied by a significant surge in bitcoin prices in the months preceding and following the event. For example, in the 365 calendar days after the November 2012 halving, bitcoin prices rose an astounding 8,447%, when the reward was cut from 50 BTC to 25 BTC.[1]

While the pre-halving price rallies have shown a diminishing trend over time, the historical pattern suggests the potential for Bitcoin to reach new all-time highs in the aftermath of the 2024 halving as well.[1] However, analysts at JPMorgan and Deutsche Bank have cautioned that the impact of this halving may be mostly baked into current bitcoin prices, and a large upward movement may be limited.

The Evolving Landscape: Spot Bitcoin ETFs and Derivatives

The landscape surrounding bitcoin has evolved significantly since the previous halving in 2020, particularly with the approval of spot bitcoin ETFs and the influx of institutional capital into the market. These ETFs have generated substantial daily demand, surpassing the pace of new bitcoin supply even before the halving, and have the potential to absorb a considerable portion of the limited new issuance.

Additionally, the emergence of a robust, regulated derivatives market has enabled price risks to be hedged, facilitated the management of bitcoin demand risk, and provided market participants with actionable price discovery. This shift could mean that selling pressure from miners is less likely to act as a drag on bitcoin prices going forward, as miners can now hedge their future bitcoin revenue.

Implications for Miners and the Broader Ecosystem

The impending halving poses both challenges and opportunities for miners. Decreased bitcoin reserves held by miners, coupled with heightened competition and record-high hash rates, underscore the need for operational efficiency and strategic adaptation.[1] The halving may also catalyze merger and acquisition activities among mining firms, driving industry consolidation and fostering innovation in sustainable mining practices.

Furthermore, the recent surge in retail demand can be attributed in part to the rise of Bitcoin Ordinals BRC-20 tokens, which have the potential to drive on-chain activity and increase transaction fees, thereby bolstering miners' revenue streams amid declining block rewards post-halving.

Looking Ahead: A New Era for Bitcoin

As the 2024 halving approaches, the confluence of factors, including the approval of spot bitcoin ETFs, the evolution of a large liquid derivatives market, and the potential impact of Ordinals, could usher in a new era for bitcoin. While past halving cycles offer valuable insights, the unique dynamics at play this time around suggest the future trajectory of Bitcoin adoption and network growth warrants close monitoring.

With 28 more halving events expected over the next 112 years, maintaining a balanced perspective is imperative to navigating the evolving Bitcoin landscape, as institutional and retail interests converge with regulatory developments and macroeconomic shifts.